Are you considering purchasing an Executive Condo (EC) but are not sure where to begin? To help you through every stage, from eligibility and financing to booking and resale, we have put together an extensive list of Frequently Asked Questions (FAQ). Locate the information you require and confidently make well-informed decisions. We may be reached via phone if you have any additional inquiries!

-

What is an Executive Condominium (EC)?

An EC is a type of hybrid housing in Singapore that combines features of public and private housing. Built and sold by private developers, ECs have condo facilities but are subject to certain HDB rules for the first 10 years.

-

Who is eligible to buy an EC?

To be eligible to buy an EC, you must:

1) Have at least 1 Singapore Citizen (example: SC + SC or SC + SPR)

2) Form a valid family nucleus under the Public Scheme, Fiancé/Fiancée Scheme, Orphans Scheme, or Joint Singles Scheme

3) At least 21 years old or at least 35 years old for Joint Singles Scheme

3) Household income must not exceed S$16,000

4) Not own or have disposed of any private property in the last 30 months, including overseas. -

Can singles buy an EC?

Singles aged 35 and above can buy only resale ECs (after MOP). Singles cannot buy new ECs directly from developers unless applying with others under the Joint Singles Scheme.

-

What is the Minimum Occupation Period (MOP) for ECs?

The MOP for ECs is 5 years, starting from key collection. During this period, the EC cannot be sold or rented out as a whole.

-

Can you sell EC before MOP?

No, you cannot sell your Executive Condominium (EC) before completing the 5-year Minimum Occupation Period (MOP).

The MOP is a mandatory period (5 years from the date you collect your keys) during which you and your family must physically occupy your EC. You cannot sell, transfer, or rent out the entire unit during this period.

Selling, transferring ownership, or subletting the entire unit before fulfilling the MOP is strictly not allowed and considered a breach of HDB regulations. The only exceptions are rare and typically involve special circumstances and such cases require HDB’s approval.

If You Breach MOP rules, HDB can take enforcement action, which may include compulsory acquisition of your EC. You may also be required to pay financial penalties.

Summary: You must occupy your EC for at least 5 years before you are allowed to sell it on the open market. Always check with HDB if you have unique circumstances requiring special consideration.

-

Is EC considered private after 5 years?

No, an Executive Condominium (EC) is not considered fully private after 5 years. After the initial 5-year Minimum Occupation Period (MOP), ECs can be sold on the open market, but only to Singapore Citizens and Permanent Residents (PRs). The property is still subject to certain HDB regulations and is not yet fully privatised. Full privatisation occurs only after 10 years from the Temporary Occupation Permit (TOP), at which point the EC is treated as private property and can be sold to foreigners, with all HDB restrictions lifted.

After 5 years:

1) ECs can be sold to Singaporeans and PRs.

2) Owners can buy private property or invest in one.

3) HDB rules still apply in some aspects.After 10 years:

1) ECs become fully private properties.

2) All restrictions are lifted; units can be sold to anyone, including foreigners.In summary, ECs are only considered fully private after 10 years, not after 5 years.

-

What happens to EC after 10 years?

After 10 years from the date of the Temporary Occupation Permit (TOP), your EC becomes fully privatised. This means:

All HDB restrictions are lifted: The EC is no longer considered public housing and is treated as a private property. You can sell or rent your whole unit to anyone, including foreigners, without any HDB-imposed eligibility conditions.

Transactable like a normal condominium: The EC can be bought, sold, or rented on the open market just like any other private condominium in Singapore.

Leasehold status remains: While the EC is now private, it remains on its original 99-year leasehold tenure; it does not become freehold.

Greater market potential: With the ability to sell to foreigners, your pool of potential buyers and tenants increases, which may positively impact your property’s exit value and liquidity.

In summary, after 10 years, your EC is fully privatised and can be freely transacted on the private market, with all initial HDB restrictions removed.

-

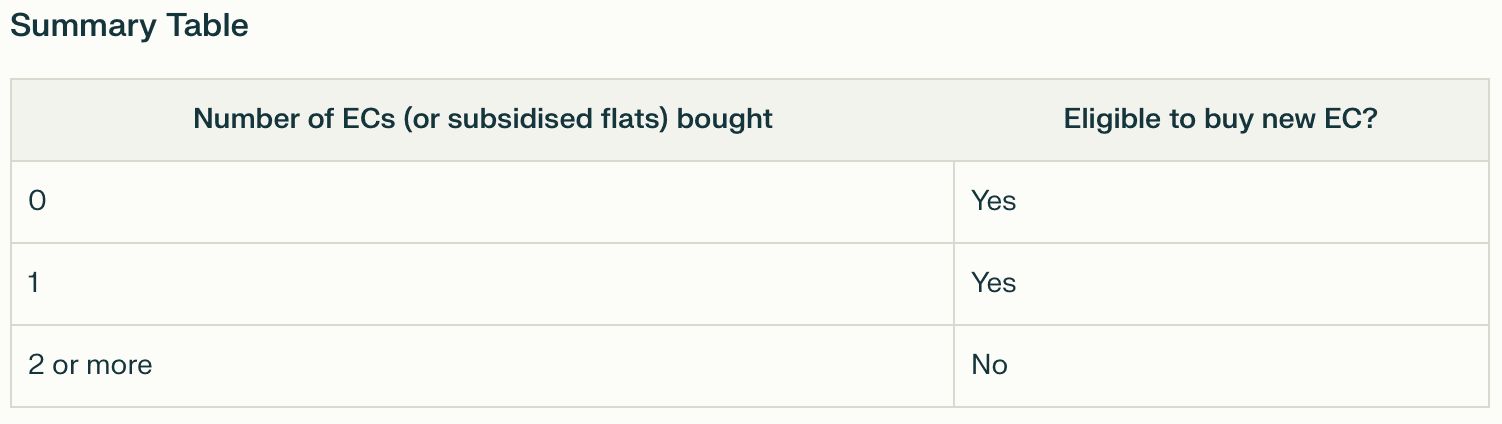

How many times can you buy EC?

You can buy an Executive Condominium (EC) up to two times in your lifetime, provided you meet all eligibility conditions each time. This is similar to the rules for buying other subsidised HDB flats.

Key Points:

1) Only first-timer and second-timer home buyers are eligible to purchase an EC from a developer.

2) If you have already bought two subsidised homes (e.g. HDB flats, DBSS flats, or ECs bought directly from a developer), you are not eligible to buy another new EC.

3) You must also meet other criteria, such as the income ceiling, citizenship, family nucleus, and property ownership restrictions at the time of application.If you are considering buying a resale EC (i.e., after the 5-year Minimum Occupation Period), the restrictions are less strict, and there is no limit on the number of resale ECs you can purchase, but eligibility for grants and other subsidies will not apply.

-

Can I buy a private property after purchasing an EC?

Yes you can buy a private property after you have fulfilled the 5-year MOP for your EC.

-

Am I eligible for CPF Housing Grants for ECs?

Yes, eligible first-timer Singapore Citizens can apply for CPF Housing Grants when booking a new EC from a developer up to S$30,000.

-

Is a loan from HDB available for EC purchase?

No, you will need to obtain a bank loan. HDB loans are not available for ECs.

You can get in touch with us an we can refer you to the mortgage bankers that works closely with us that are well versed with ECs.

-

What happens if I own another flat when buying an EC?

If you own an HDB flat or DBSS flat, you must sell it within 6 months of receiving the keys to your new EC.

-

Can I buy an EC if I’m engaged but not yet married?

Yes you can buy an EC if you are engaged but not yet married under the Fiancé/Fiancée Scheme.

Note: Have at least 1 Singapore Citizen (example: SC + SC or SC + SPR). Foreigner is not eligible.

-

Can I buy an EC if I own private property?

No, you are not eligible to buy an EC if you, your spouse, or any owner/core occupier listed in the application owns private property in Singapore or overseas. If you’ve disposed of private property, you can apply 30 months after the disposal date.

-

What documents do I need to submit when booking an EC?

You need to provide documents to verify your eligibility, including proof of identity/citizenship, relationship/marital status (e.g. birth certs/marriage certs) and income (e.g. payslips, CPF statements, etc.). Check with the developer for specific requirements.

-

Can I apply for an EC if I have an existing HDB flat application?

Yes, you can apply for an EC if you haven’t booked a flat with HDB. HDB will cancel your flat application once you book an EC unit. Check with the developer for specific forms to execute.

-

What happens if I cancel my Build-To-Order (BTO) or Sale of Balance Flats (SBF) booking?

If you cancel a BTO/SBF booking launched, you can’t apply for an EC within one year after the cancellation of booking.

-

What are the penalties for cancelling an EC booking?

If you give up your EC unit before signing the Sale and Purchase Agreement (S&P), you’ll forfeit 25% of the booking fee.

Booking fee for ECs are currently at 5% of the property purchase price, hence 25% of 5% would work out to be 1.25% forfeited and you will be refunded with 3.75% remaining of your booking fee.

-

What payments are required when buying an EC?

You must pay an option fee (5% of the purchase price) by bank transfer, cheque or cashier’s order upon booking. The balance 15% of the purchase price must be paid as per the Option To Purchase timeframe. CPF Housing Grants can be used for the downpayment.

-

What is the difference between Normal Payment Scheme (NPS) and Deferred Payment Scheme (DPS)?

The difference between NPS and DPS is approximately 2% to 3% premium. With the DPS, the EC buyers can defer their payment till key collection stage (i.e. TOP stage).

DPS may affect the purchase price of your EC unit. Please check with the developer for more details.

-

Can I use CPF to pay for my EC?

Only the owners can use their CPF money to pay for the EC unit. Kindly note there is a hierarchy order: Cash -> CPF -> Bank Loan.

Disclaimer: While reasonable care has been taken in preparing this website, neither the developer nor its appointed agents guarantee the accuracy of the information provided. To the fullest extent permitted by law, the information, statements, and representations on this website should not be considered factual representations, offers, or warranties (explicit or implied) by the developer or its agents. They are not intended to form any part of a contract for the sale of housing units. Please note that visual elements such as images and drawings are artists’ impressions and not factual depictions. The brand, color, and model of all materials, fittings, equipment, finishes, installations, and appliances are subject to the developer’s architect’s selection, market availability, and the developer’s sole discretion. All information on this website is accurate at the time of publication but may change as required by relevant authorities or the developer. The floor areas mentioned are approximate and subject to final survey.